Many credit cards these days are moving away from annual fees. In fact, only about a quarter of them charged these fees in 2018. And sometimes credit cards can actually help you beat fees—for example, by letting you use cash-back points to cover checked airline luggage.

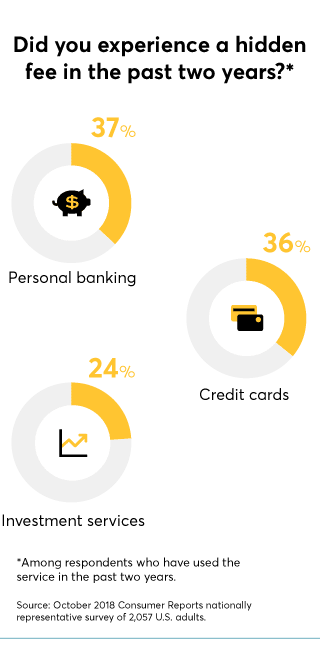

But many cards still come with their own set of annoying, sneaky fees, according to a recent nationally representative Consumer Reports survey of 2,057 U.S. adults.

More than a third of Americans who said they had used a credit card in the past two years said they had experienced an unexpected or hidden fee.

Worse, avoiding those fees can be difficult—though sometimes possible. Here are some fees to watch out for, and tips for how to avoid them.

Late Payments

Credit cards often punish people for failing to pay the minimum due on time, with late payment fees as high as $38 in 2018, according to CreditCards.com, a card comparison site.

The fix: There are a few cards—such as the Citi Simplicity and PenFed Promise Visa—that don't charge the fee. (For the PenFed card, you will need to join the credit union.) Better yet, don't be late. Sign up for automatic minimum payments or put reminders on your phone or calendar.

Balance Transfer

It can sometimes be smart to transfer the balance on one card to another one with a lower rate—though the cost for that can be steep: 3 to 5 percent of the transfer amount.

The fix: Sign up for a card, such as the BankAmericard for Students or Slate from Chase, that doesn't charge for transfers in the first 60 days of card membership.

Cash Advances

Using your credit card to get cash isn't a great idea because you have to start paying interest right away and there's often a fee of 2 to 5 percent of the borrowed amount.

The fix: One card that doesn't have that fee is the PenFed Promise Visa.

Foreign Transactions

Using your card outside the U.S. typically comes with a fee of 3 percent of the transaction amount, according to CreditCards.com.

The fix: Use a travel rewards card, such as the Capital One VentureOne credit card, which doesn't charge these fees.

What the Fee?!

Are you tired of the endless stream of add-on charges that appear on your bills? On the TV show "Consumer 101," Consumer Reports' expert explains to host Jack Rico how to avoid these pesky fees.

Editor's Note: This article also appeared in the July 2019 issue of Consumer Reports magazine.