One thing that most of my clients struggle with is saving money (and not touching that money). I’m constantly asked my opinion on the best way to grow savings. Enter Digit, which is perhaps the easiest way to save money ever, well other than not spending money.

I was introduced to Digit earlier this year by my blogger bud J. Money over at Budgets Are Sexy, but I wanted to hold off on doing a review until I let the honeymoon period pass.

How Does Digit Work?

Digit intelligently automates your savings.

You can sign up via your desktop or mobile phone. You will be prompted to enter your primary checking account information. Using it’s own internal algorithm, Digit studies your spending habits and deposit trends and estimates how much money you can spare to save. It’s cautious at first, so that it can better understand your spending habits and so that you can get used to expecting to have small amounts of money deducted from your account regularly.

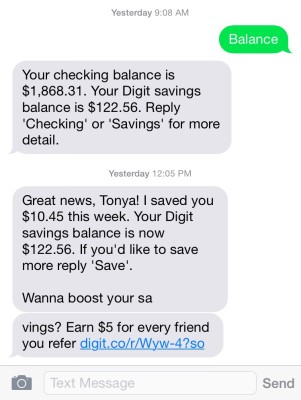

I have been using digit for 6 months now and my account has never gone into overdraft because of it. But it’s good to know that they do have an overdraft guarantee and will pay any overdraft fees you incur as a result of using the program. It is a very smart and sophisticated program. One of the coolest features is that they send your bank account balance every morning along with any noteworthy changes such as cleared checks or deposits. (You should still check your account manually though.)

In short:

- Digit calculates and estimates out how much you can afford to save, based on your expenses.

• It adjusts that amount as your spending changes.

• It knows your upcoming bills and accounts for them in deciding how much to save.

Where does the money go?

When you signup for Digit you receive your own Digit account which will hold all savings until withdrawn. Any funds held in your Digit account are FDIC insured up to a balance of $250,000.

There are no fees for having a Digit account. Digit does make money to cover their operational cost from any interest earned on your savings funds. They are currently working on ways to offer their users a return on their savings in the future.

Whenever you are ready to use the money you can transfer the money to your bank account. I like Digit because it makes your savings inconvenient so that you don’t blow money on stuff that’s not important. To access your money you have to transfer the money from your Digit account over into your checking account, which takes about 2-3 days.

What You Should Know:

- Digit is easily and best communicated through a text platform so they text you these alerts everyday or when you get an affiliate sign up.

- If you want to save, you don’t have to wait for it to save for you. You can elect to save money. You just need to type in “save” and send them a text. They will text you back and ask how much you want to save.

- The more money you keep in your account the more money will be transferred over. I have 5 bank accounts (personal, joint house, emergency savings, long term savings, and business) and I only have Digit connected to my personal account so the average balance is a bit less.

My Final Thoughts

I really enjoy using Digit but it’s not the only savings strategy I use because I still put already save 20% of all of my income but Digit allows me to save a little something extra.

I ran into a few issues the first 2-3 months because Digit had not figured out how to work with my bank’s strict security settings. But they got it situated. I also accidentally sent the wrong command, pausing all digit activity but customer service responded immediately after I contacted them and fixed the problem.

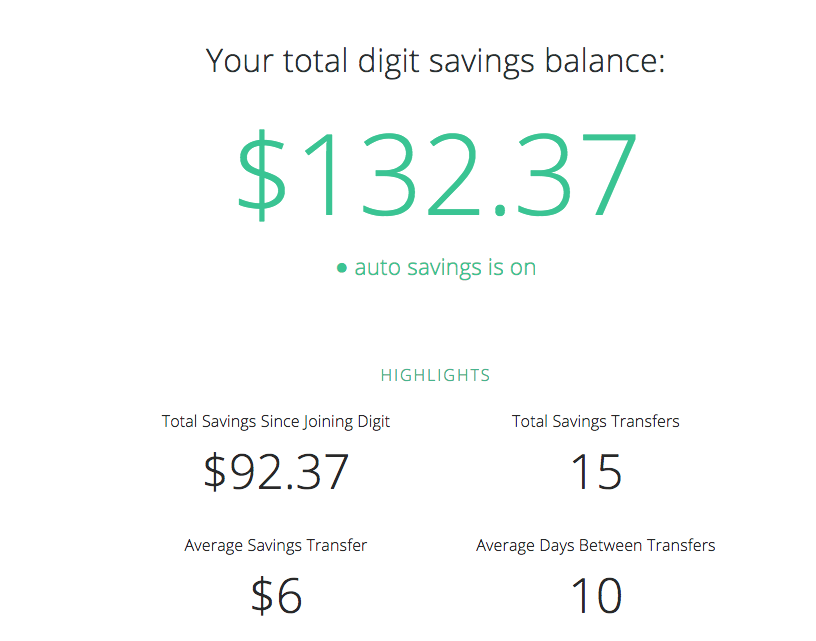

My account has doubled in the past month now that Digit is regularly socking money away for me.

My Digit Account Snapshot

To date they have saved their customers over $1 million dollars and that’s nothing to sneeze at. It’s one of the most intelligent ways to automate your savings to date. At the end of the day, you have nothing to lose. I recommend that everyone at least give Digit a try. Sign up for Digit Now

Do you use Digit? Let me know how you like it!

And remember:

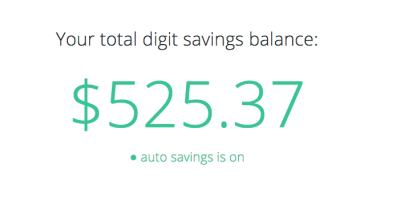

There is no secret. Financial freedom happens when you save and invest more than you spend. Click To TweetUpdate things are really rolling! As of August 20,2015 I’ve saved more than $500 in my Digit account.

(Digit has a great affiliate program, so I receive money in my digit account for everyone who signs up. And you can too!)

You said: