Secrets to Credit Score Success

How to keep track of your score, get it as high as possible—and keep it that way

If you think your credit history determines only the interest rate you get on home mortgages, car loans, and credit cards, you’d be wrong, but you certainly wouldn’t be alone.

In a recent U.S. News & World Report survey, less than half of the 1,497 respondents knew that in many states poor credit could lead to higher home and auto insurance rates or being denied an apartment (CR opposes the use of credit reports for these purposes).

The consequences go even further: Employers in many areas can use credit reports to vet job candidates, and having a low credit score could mean paying $4,000 more for a typical car loan or $200,000 more for credit over the course of a lifetime than someone with a high credit score.

There are several types of credit scores, but the FICO score is one of the most widely used by lenders, which makes it a good barometer of your overall creditworthiness.

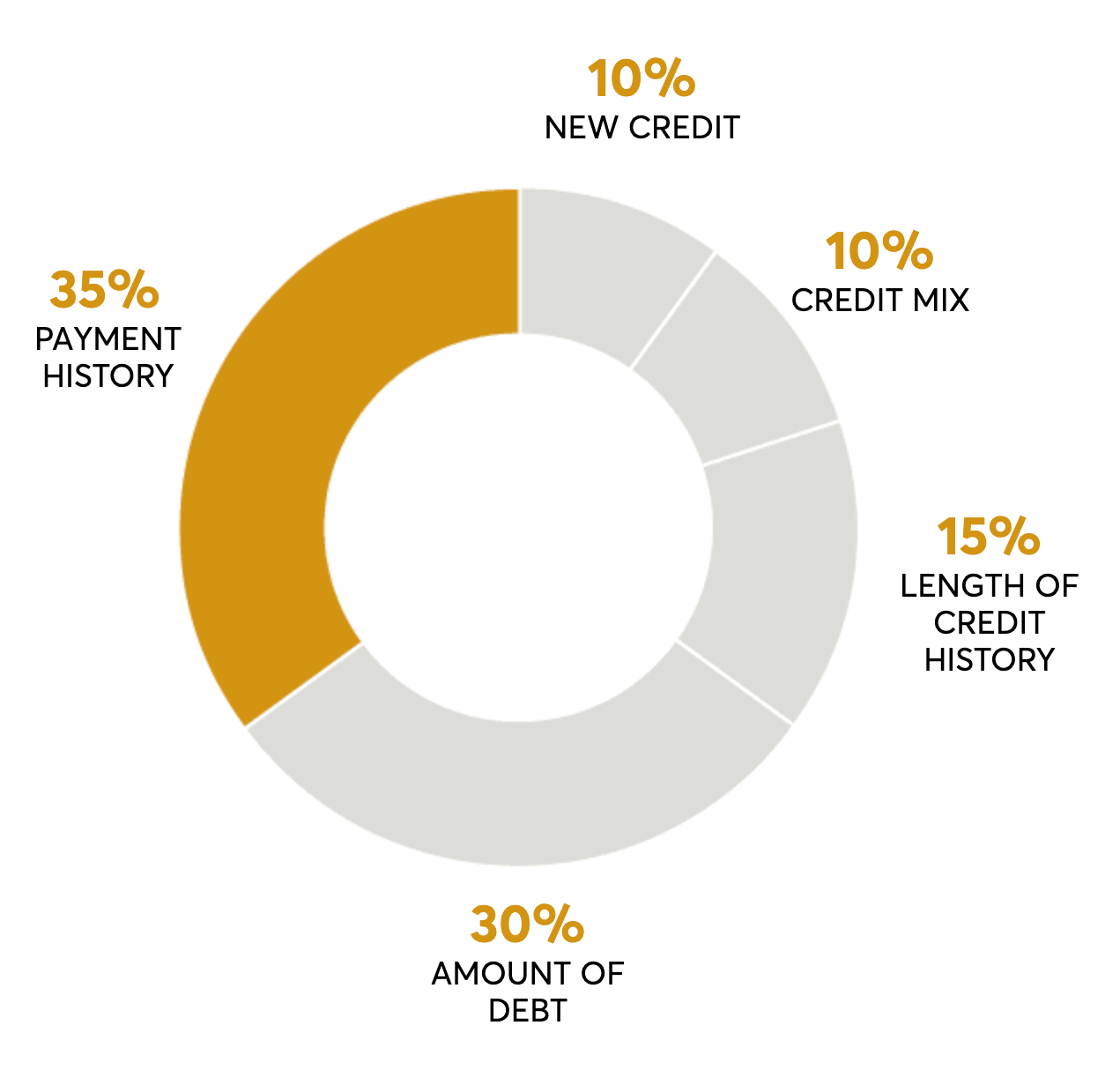

According to the Fair Isaac Corporation, which creates more than a dozen versions of the score for various types of lenders, all of them are based on assorted forms of credit data (such as payment history and amounts owed) provided by the three major credit bureaus—Experian, TransUnion, and Equifax. Each form of credit data is given a different weight (see “The 5 Keys to Your Credit Score,” below).

Finding your credit score can be a frustrating process if you don’t know where to look. The Fair Isaac Corporation and credit reporting agencies will provide your FICO score for a fee, but there are several ways to find it at no charge. For instance, if your bank, credit card issuer, or lender participates in FICO Score Open Access, you may be able to get it free just by logging in to your account.

Making Sense of Your Score

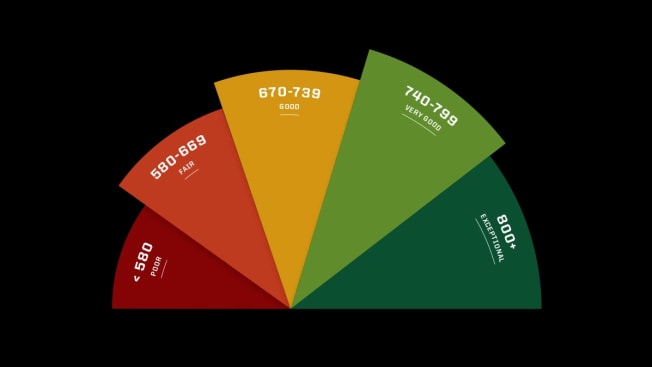

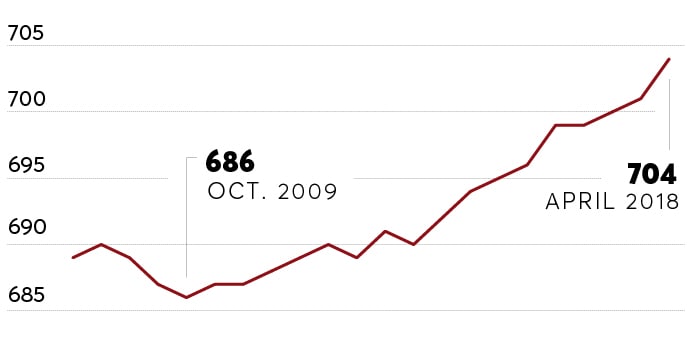

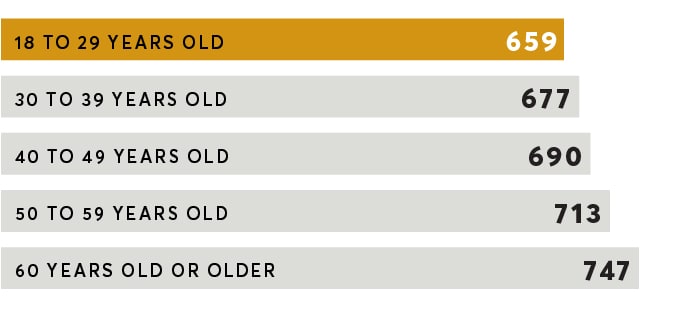

FICO scores typically range from a low of 300 to a high of 850. (The national average FICO score is 704.) In general, a score above 800 will qualify you for the lowest interest rates, though even a score in the high 600s should qualify you for a favorable rate.

Experian, one of three major credit bureaus, defines the boundaries this way:

800-plus: Exceptional. Less than 1 percent of borrowers in this range are likely to become seriously delinquent. They’ll easily be approved for the lowest rates.

740-799: Very good. One percent of borrowers in this category are likely to become seriously delinquent. They could be offered the lowest rates from lenders, but it’s not a given.

670-739: Good. Eight percent could become seriously delinquent. This stratum includes the average U.S. credit score. People in this range are considered an “acceptable” lending risk.

580-669: Fair. An estimated 27 percent of the people in this group could become seriously delinquent, making them likely candidates for subprime loans at higher rates.

579 and below: Poor. This group is considered a poor lending risk: Roughly 62 percent could become seriously delinquent. They will be eligible only for the highest interest rates, if they can get credit at all.

Though missing just one payment can ding your score, even a major downturn in your luck or behavior is unlikely to drop it into the very lowest range.

Bruce W. McClary, vice president of communications at the National Foundation for Credit Counseling, a group that represents nonprofit credit counseling agencies, says the lowest score he’s ever seen was 425, for a consumer who had already been in bankruptcy and was delinquent with several creditors.

“Obsessing over perfecting your score might be a waste of time,” says Katie Ross, education and development manager for American Consumer Credit Counseling, a nonprofit that offers guidance to consumers. Instead, “focus your efforts on keeping it within a healthy range,” she says.

supplied by credit reporting agencies:

10 Ways to Raise Your Credit Score

Taking these actions can help to raise a sagging score. Just don’t expect it to happen overnight: Depending on the reasons for a poor score, it could take from 12 to 24 months to see a difference.

1. Regularly monitor your credit reports. Mistakes on your credit reports can be costly—and common. A study by the Federal Trade Commission found that 1 in 5 consumers had an error on his or her credit report that was corrected after it was disputed. Consumers are entitled to receive three free credit reports each year—one from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. A smart way to monitor your credit is to go to annualcreditreport.com and request a free report from a different agency every four months. Common errors to look for include: credit accounts that aren’t reflected, duplicate credit accounts, debts incurred by a former spouse, and bad debts older than seven years. You can initiate a dispute online at each of the three major credit reporting agencies.

2. Pay your bills on time. Approximately 35 percent of the FICO score is determined by your payment history, and 96 percent of those with the highest FICO scores have no missed payments. It’s better to pay the minimum on credit cards each month than to fall behind.

3. Don’t apply for several credit cards at once. This generates numerous inquiries into your credit history, which may lower your score. Another reason: Opening several new credit accounts at the same time reduces the average “age” of your accounts, which can also lower your credit score. However, multiple requests within a 45-day period for a single type of credit (mortgage, auto loan, or student loan, for instance) are counted as a single inquiry to allow consumers to shop around for the best rate. These are less likely to lower your score.

4. Don’t cancel unused cards (unless they carry an annual fee). Roughly a third of your score is based on the ratio of credit used to total available credit. Eliminating a card will lower your available credit and can work against you.

5. Keep credit balances low. Because a high credit ratio can negatively affect your score, maintaining a low revolving credit balance is wise. (Most people with the highest FICO scores owe less than $3,000 on revolving accounts.)

6. If you charge everything on a rewards card for the points, switch to cash or a debit card for a couple of months before applying for new credit. Even if you pay your balances in full every month, a lot of debt relative to your credit limit can still be viewed negatively.

7. Maintain a variety of credit types. Successfully paying, say, an auto loan, a student loan, and credit card bills over the same period shows that you’re able to juggle different types of credit. That diversification accounts for 10 percent of your score.

8. Pay off debt in collection. With the most current version of the FICO score, debt that was referred to a collection agency but has been paid off will no longer count against you. (Always dispute any debt that has been wrongly assigned to you.)

9. Get a secured credit card after bankruptcy. If you’ve been through bankruptcy, using a secured credit card backed by a refundable deposit may be an effective way to start rebuilding your credit. A bankruptcy will have less impact on your score over time if you don’t default on new loans. It may be a while before you can access credit inexpensively again: Chapter 7 and Chapter 13 bankruptcies stay on your credit report for up to 10 years.

10. Consider new tools that can boost your credit score. Consumers with little credit history or less-than-stellar scores may now use two new tools that could boost creditworthiness by taking into account additional information, such as utility or mortgage payments and bank balances. Click here for the pros and cons of these.

Editor's Note: This article also appeared in the August 2019 issue of Consumer Reports magazine.